Financed emissions: what are they?

To begin our discussion, we need to define the complex metrics of what makes up financed emissions in the financial sector.

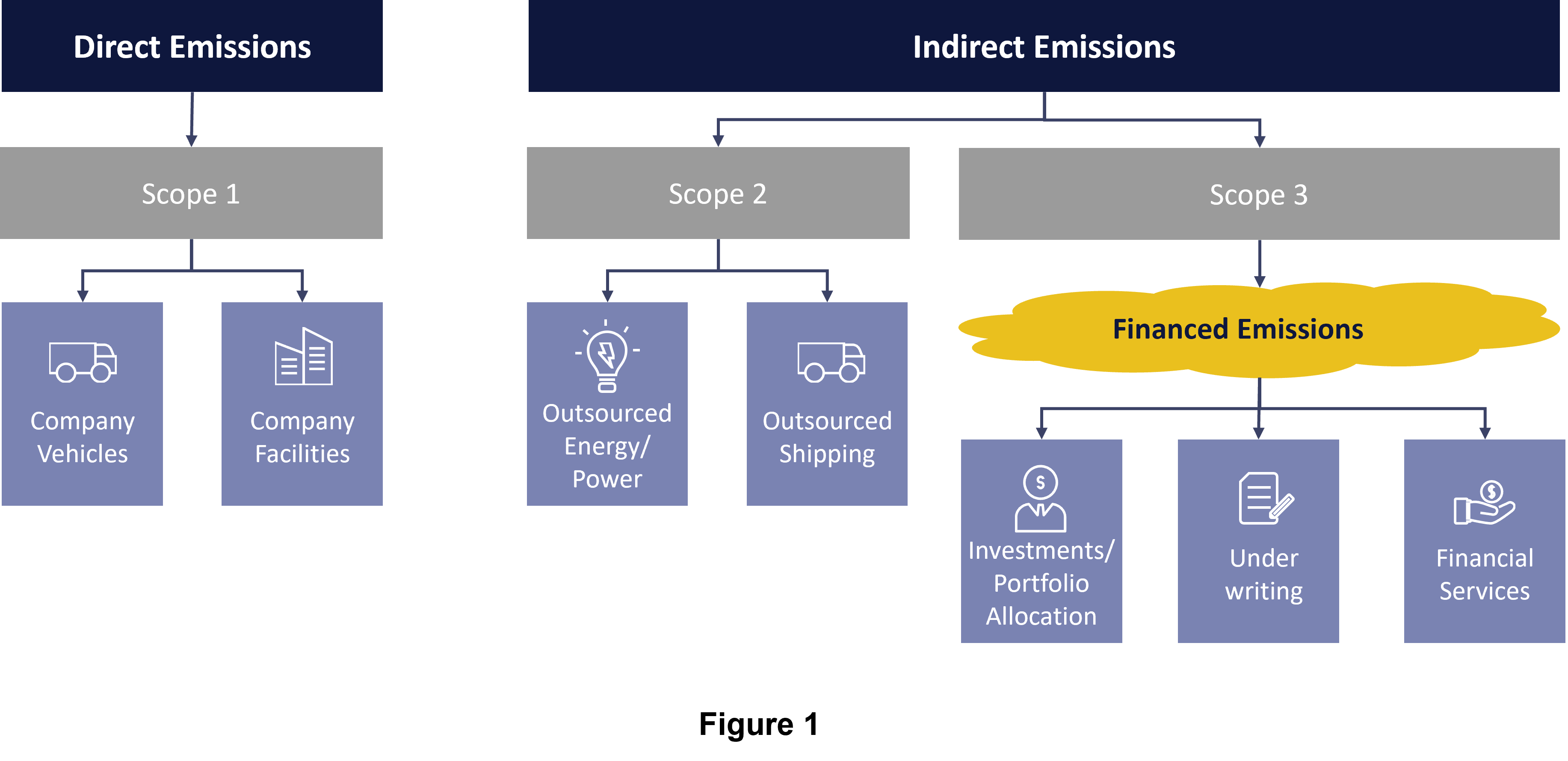

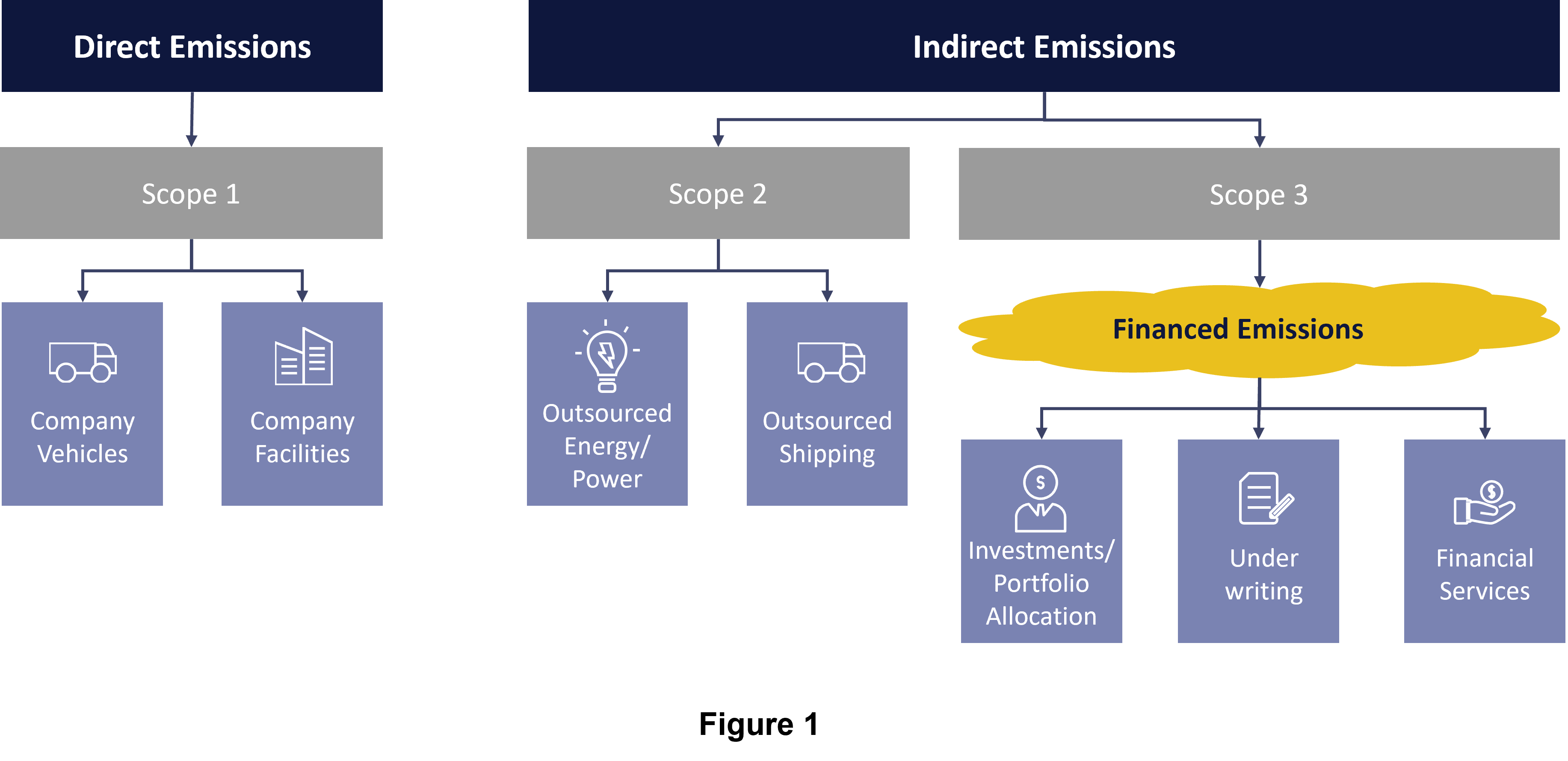

Put simply, financed emissions are the indirect, scope 3 emissions[1] that can be related to loans, underwriting, investments, and any other forms of financial services. These indirect financed emissions are the consequence of conducting financial activities (please see figure 1). Whereas direct scope 1[2] and 2[3] emissions are from sources that are exclusively owned, operated, or controlled by the reporting institution.

——————————————————————————————————————————————————————————————————————————

[1] Scope 3 emissions are any indirect emissions that take place within a company’s value chain. These emissions will come from the consequences of activities that occur from sources not owned or controlled by the company.

[2] Scope 1 emissions come from the direct consequences of owning and controlling sources of emissions within a company. This could be owning and operating company vehicles.

[3] Scope 2 emissions come from a company’s indirect, but owned emissions. This could be the outsourcing of power generation from a utility provider.

——————————————————————————————————————————————————————————————————————————

Financed emissions are a measurement tool that can be used to better understand the emissions being financed by a firm’s allocated capital or a fund’s investments. Being able to leverage your financed emissions data can allow a company to make sense of their past and develop a more forward-thinking investment strategy.

Measuring financed emissions is a complex and difficult task from an investor perspective. On a micro level, there may be thousands of issuers within portfolios that make data coverage and quality extremely challenging. Understanding the capital structure of investees (i.e., the split between equity and fixed income sources) becomes critical to correctly attribute emissions to specific investors. For a detailed explanation on carbon accounting methodologies for equity, debt investments, and project finance please see the Chapter 15 of the Technical Guide for Calculating Scope 3 Emissions from the Greenhouse Gas Protocol.

Additionally, the retrieval of information becomes even more difficult for financial institutions since not all investees will generate or retain information about their emissions or completely understand climate-driven risks posed to their business models. This leads to an absence of standardized, credible sources of current and consistent data. Likewise, these gaps in information can leave room for double counting to occur between multiple parties. This is a situation where emissions from a single source are counted twice or several times. Double-counting may arise between organisations in two forms according to a report by Climate Focus: The first method is known as double claiming, where two or more organizations will report the same emission reductions to ensure they align their targets to nationally determined contributions. The other case is called double issuance, in which multiple reduction units, carbon credits, or climate reduction projects, are registered within the company books for the same mitigation benefit.

Thankfully, to solve for these issues, there are new and prevalent calculation methodologies that allow asset managers to estimate their financed emissions, plan their emission reduction schedules, and overcome any gaps from the lack of available data.

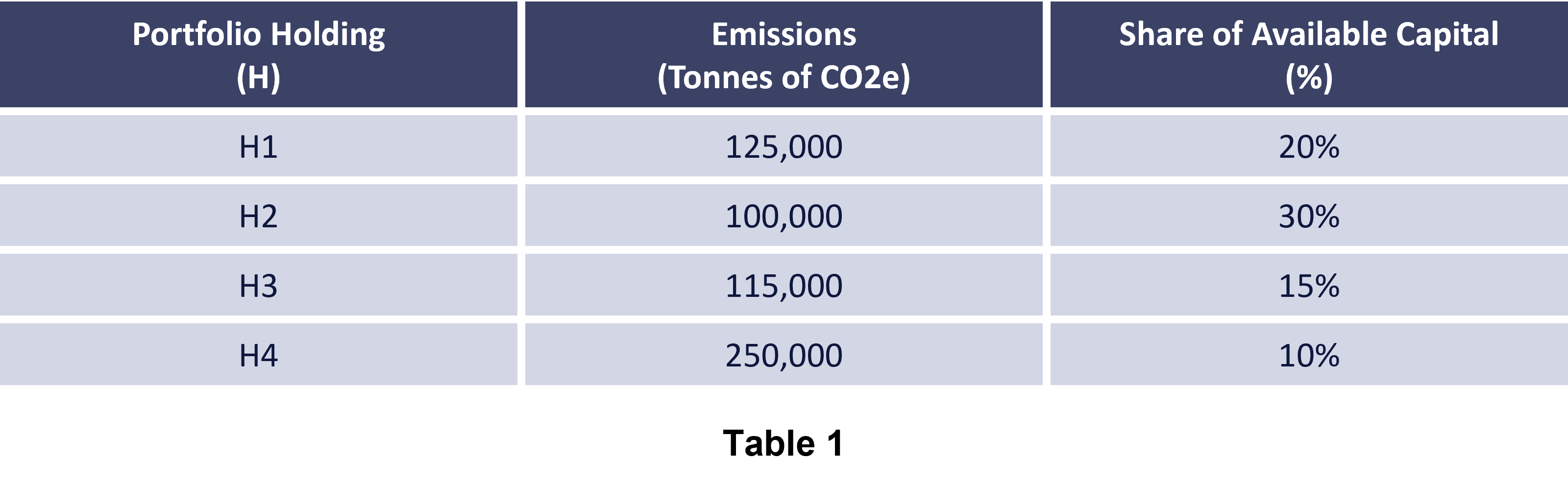

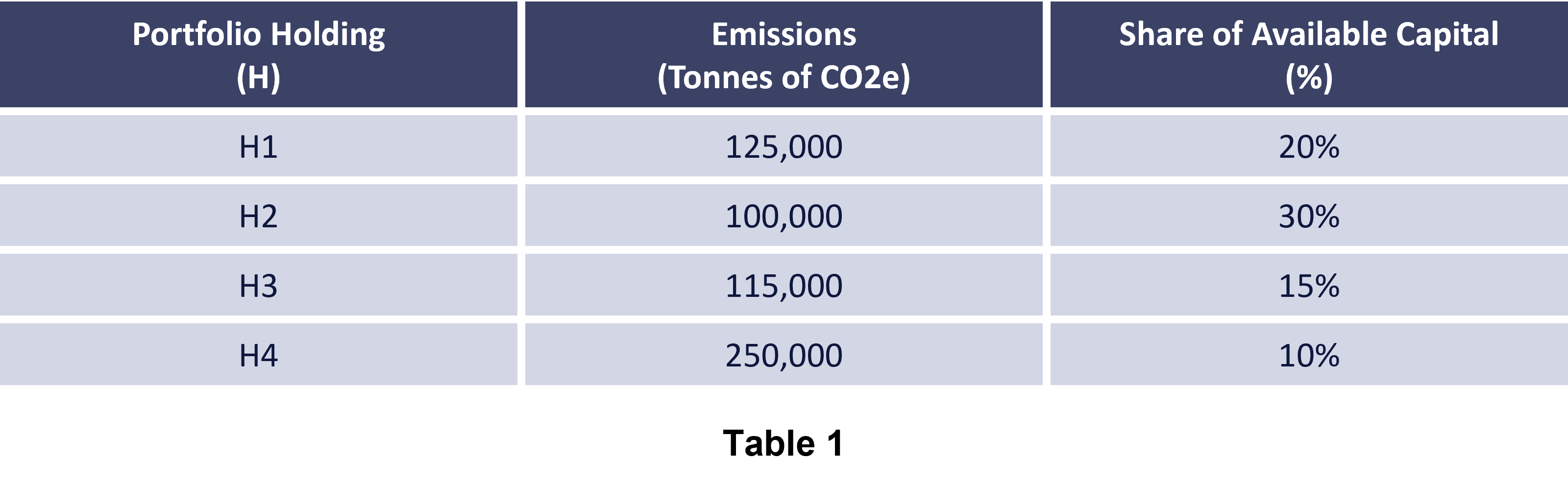

To help illustrate the topic of financed emissions, consider a simplified example of an asset manager that is entrusted with the responsibility of allocating investor capital into a fund with a diverse array of equities, alternate investments, and fixed income securities. The manager currently holds four positions with 20%, 30%, 15% and 10% respectively of the total capital available (please see table 1).

To figure out the total financed emissions that are being produced by this portfolio, we need to consider the tonnage of carbon dioxide equivalents (“CO2e”) that are being produced by each individual holding (please see figure 2). For context, a carbon dioxide equivalent or CO2e is a metric unit of measurement used to compare the global warming potential of various GHGs that can be accounted for over a certain period.

As a result of this portfolio allocation, the asset manager can determine the total financed emissions within their portfolio by finding the sum of products between the tonnage of each holding and the share of available capital. In this example, the resultant total financed emissions are 97,250 tonnes of CO2e (please see figure 2 for reference)

While this example may appear straightforward, as highlighted before, the challenge for investment managers is that as portfolio holdings grow, it becomes increasingly more difficult to attribute the exact sources of emissions within a fund, especially when some portfolios can have thousands of different investee companies.

Why do financed emissions matter?

Financed emissions are critical to consider since they are one of the largest leading contributors to global GHG emission levels. From a recent report by Sierra Club and CAP, research showed that the 18 largest US banks and asset managers were responsible for financing 1.968 billion tons of carbon dioxide. For context:

- If these institutions were a country, they would have the fifth largest emissions in the world

- Financed emissions from these institutions are equivalent to 432 million passenger vehicles driven in a single year

- Financed emissions from the eight banks in the report are equivalent to the energy consumption of 80 million homes for a single year

- Financed emissions from the 10 asset managers presented are equivalent to 3 billion barrels of oil consumed

With the facts presented in the report, it should not come as a surprise that indirect financed emissions account, on average, to more than 700 times the direct emissions emitted by the financial sector according to the Carbon Disclosure Project (“CDP”).

What does this mean for portfolio managers?

According to CDP, less than half of the financial sector participants report actions that align with the 2°C global warming target of the Paris agreement.

It is becoming increasingly critical for asset managers to understand and disclose the impact of their investments to their clients, to continue to raise capital for the financing of their day-to-day activities. A Vontobel survey found that about 99% and 95% of European and North American investors respectively, consider ESG in their investment decisions as a result of a changing investor mindset. Thus, it is essential that financial institutions practice transparency within their management and ownership.

It should also be noted that not only are financial institutions underreporting emissions, but they are also underestimating the financial risk of climate change itself; this can be classified as “Financed Emissions Risk”. This is the risk that regulatory limitations on emissions and swings in social and technological advances will increase costs and market competition which can adversely influence the value of the investments that financial institutions and asset managers are exposed to through their investments.

Given that direct emissions are such a small part of asset managers’ business models, it is important to start focusing efforts on the indirect risks of financing emissions such as credit risks and defaults from the devaluation of investments and potential stranded assets.

As a result of the demand for transparency and an increased awareness of financed emissions risk, asset managers and asset owners are under pressure to disclose, manage and report the financial climate risk they are subjecting their investments to.

How can firms determine and measure their financed emissions?

This is the billion-dollar question that poses difficulty to financial institutions and entities due to the complexity and challenges that come with reporting and disclosing emissions. This challenge can be attributed to the large and dense volumes of data that must be taken into consideration when dealing with millions of clients, financial products, and data points. When attempting to measure the emissions from each loan, investment or debt instrument, investment managers must:

As many asset classes have different paces and emission levels, it can be daunting to find a starting point to calculate the carbon footprint of a portfolio. However, there are many modern technologies and software tools being implemented to assist the financial sector in tracking their financed emissions.

Conclusion

With the brunt of GHG emissions coming from the indirect activity of financial institutions, asset managers and owners need to start focusing on financed emissions as we move towards the goal of achieving net-zero emissions. As the pressure for transparency and disclosure of the carbon footprint within portfolios is increasing, measuring financed emissions is one of the biggest challenges facing the financial sector today. However, with advancements in climate disclosure and carbon management technology, firms are starting to embrace the large volumes of data that highlight the ESG factors that influence investor decision-making.

How can Invartis help?

Determining how your organisation can begin to measure and disclose their carbon footprint can be a challenge. With the right ESG integration and implementation process in place, we can help put your climate initiatives at the forefront of capturing investor attention.

If your organisation needs support in measuring their financed emissions and attributing their highest emitting positions, feel free to schedule a call with one of our ESG integration experts.

To speak with one of our ESG experts, book a call here